Lending Club is poised to have an IPO next year. I wondered, will owning stock in Lending Club be a good investment, particularly at the IPO? For this post, I’ll cover Financial Services IPOs in general, and in a future post I’ll look at the merits of a $1 B potential market cap for Lending Club.

Financial IPOs are hot

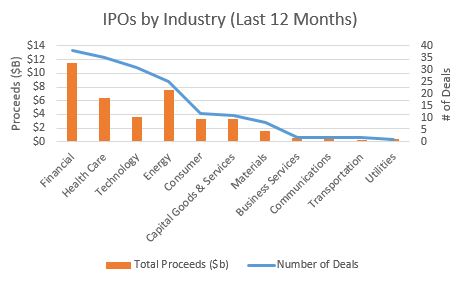

There have been more IPOs in the financial sector than any other industry in the last 12 months. Financial Services IPOs raised $11.5 B from 38 deals:

I was quite surprised, as I couldn’t recall any Financial Services IPOs recently. However, when I checked, there were some fairly big names. ING US was the largest IPO of any company in the 2nd quarter, raising $1.3 B on May 1st. EVERTEC (financial transaction processor in Latin America) was another big IPO in Q2, raising half a billion. (source)

However, Financial Services IPOs lag the market in total returns

However, Financial Services IPOs had the 2nd lowest total return of any industry. Over the last 12 months, Financial Services companies that IPO-ed returned just 5.1% to investors.

When considering investing in a Lending Club IPO, proceed with caution. Not all high-profile IPOs have delivered for investors, and Financial Services IPOs in general have garnered a fairly cold reception.

Instead of investing in a Lending Club IPO and yield potentially 5%, why not invest on the platform itself for yields of 11%?* Peer Lending Advisors can help you achieve your investing goals – sign up below for more information about how to get started investing in Peer-to-Peer Loans and how Peer Lending Advisors can help:

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Phone’ type=’text’/][/contact-form]

*past performance is no guarantee of future results – Lending Club published returns, not of Peer Lending Advisors