Note: these returns are the personal returns of Sam Fetchero, not client returns. If an investor used Peer Lending Advisors to select loans for them and they experienced the same returns, Net returns would be lower by 1.5% of assets (for asset-based fee) or 15% of profits (for peformance-based fee – for qualified clients only). There is potential for both profit and loss.

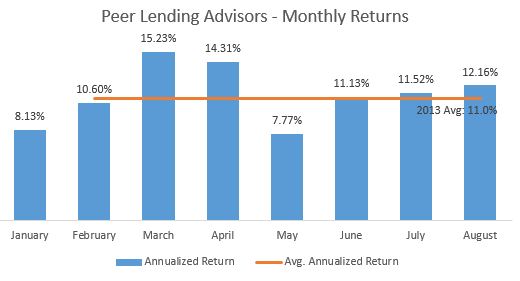

Peer Lending Advisors had another great month in August. Below you’ll see net returns, which reflect interest net of losses. The returns reflect the entirety of loans acquired, and as purchased ramped up in 2013, the portfolio has become more heavily weighted toward newer loans, which have a different charge-off curve than seasoned loans. Please note that past performance is not a guarantee of future results.

August return: 12.16%

August was another great month earning an annualized return of 12.16%. This brought the average return for 2013 up to 11.00%. Returns have been trending up for the past three months. Expect the remainder of the year to see returns similar to those experienced the past few months.

- One risk on the horizon is the impact of the slowing housing market. While Peer Lending Advisors has stayed away from borrowers in the construction industry, the impact of the slowdown of housing (and housing remodeling) will certainly drive some loans bad. Expect the short-term impact on the portfolio to be minimal, and remain cautious long-term.

Interested in how Peer Lending Advisors can help your portfolio?

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Phone’ type=’text’/][/contact-form]

Important disclosures:

- These are personal returns of Peer Lending Advisors, LLC, achieved over the timelines disclosed above in the market/economic conditions at that time. The portfolio objective is to maximize return while minimizing losses, especially in recession scenarios. Loans were purchased on both Lending Club and Prosper.

- The potential for both profit and loss exists