Note: these returns are the personal returns of Sam Fetchero, not client returns. If an investor used Peer Lending Advisors to select loans for them and they experienced the same returns, Net returns would be lower by 1.5% of assets (for asset-based fee) or 15% of profits (for peformance-based fee – for qualified clients only). There is potential for both profit and loss.

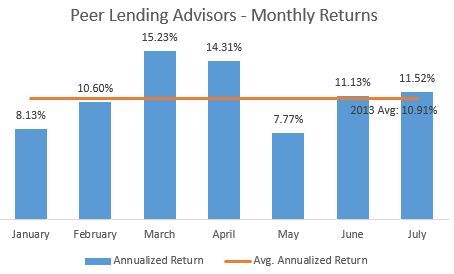

Peer Lending Advisors had another great month in July. Below you’ll see net returns, which reflect interest net of losses. The returns reflect the entirety of loans acquired, and as investments have ramped up in 2013, the portfolio has become more heavily weighted toward newer loans, which have a different charge-off curve than seasoned loans. Please note that past performance is not a guarantee of future results.

July return: 11.52%

July was another great month. Annualized return of 11.52%. This brought the average return for 2013 up to 10.91%.

There are several factors driving slightly lower returns (but still incredibly strong) in 2013 vs. 2012:

- Loan availability: Acquiring new loans remains incredibly difficult on both Lending Club and Prosper. It has taken diligence and raw horsepower to invest in the top loans on the platform

- Revised risk model on Lending Club: Lending Club revised their risk model and reduced the interest rate on several classes of loans: the loans we focus on and have the best risk-adjusted return (B, C, and D loans). We estimate this will have a 50-100 basis point impact on our net returns in the long term. The short-term impact has been minimal as these loans are still a small portion of the portfolio

- Credit policy changes (see below):

Peer Lending Advisors changed its credit policy in January and reduced our activity on the secondary market. Previously, the secondary market was being used to help supplement purchases of loans as investments were ramping up. However, the credit model couldn’t evaluate the credit worthiness of borrowers as effectively as on new loans due to older credit information.

In January, Peer Lending Advisors stopped making purchases and wrote down several of the loans in the portfolio. Beginning in May, some weakness was observed in existing loans purchased on the secondary market, so continual write-downs are being made when weakness is observed. Estimate that these loans have had ~100 basis points of impact on the portfolio in 2013, and anticipate another ~100 basis points of writedown through the rest of 2013 as these loans continue to run-off.

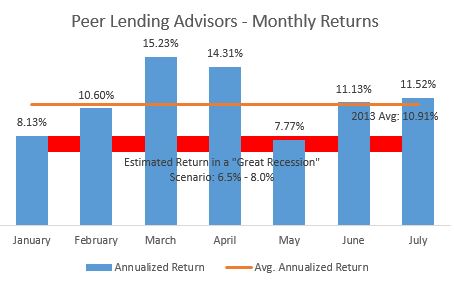

Risk-adjusted returns remain strong

Each month Peer Lending Advisors runs scenario analysis to estimate how the portfolio would hold up in a recession scenario. The toughest recession scenarios are examined to ensure the portfolio would hold up and remain, at a minimum, net neutral with no capital loss. Note that there are no guarantees.

Estimate that the return would remain strong in a recession similar in size to the “Great Recession” of 2008, and drive annual returns between 6.5% – 8.0%. This is tremendous performance, considering most asset classes would experience huge capital losses. For example, the S&P 500 lost over half its value in 2008, and home prices declined 50% in some areas.

Peer Lending Advisors doesn’t invest in high risk loans specifically because of the risk of recession. While focusing on E-grade loans and above could goose short-term returns (you’ll see many bloggers brag about high returns in this category), on a risk-adjusted basis, many of these loans are junk. Interest rates would need to be above 40% to make many of these loans profitable in the long term. Could you imagine if the default rate on these loans merely doubled? Lenders would be under water. Peer Lending Advisors triple and even quadruple losses in some scenarios to ensure portfolio resiliency.

Peer Lending Advisors will continue to stay out of this market, which will make short-term returns appear lower, but strengthen the resilience of the portfolio.

Interested in how Peer Lending Advisors can help your portfolio?

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Phone’ type=’text’/][/contact-form]

Important disclosures:

- These are personal returns of Peer Lending Advisors, LLC, achieved over the timelines disclosed above in the market/economic conditions at that time. The portfolio objective is to maximize return while minimizing losses, especially in recession scenarios. Loans were purchased on both Lending Club and Prosper.

- The potential for both profit and loss exists