Peer Lending Advisors uses its own proprietary algorithm to select P2P Loans to invest in, and doesn’t just stop with an algorithm and loan filters. Peer Lending Advisors manually underwrites every loan, including reading all the supplementary information that a computer/loan filters would miss. Let me give you an example:

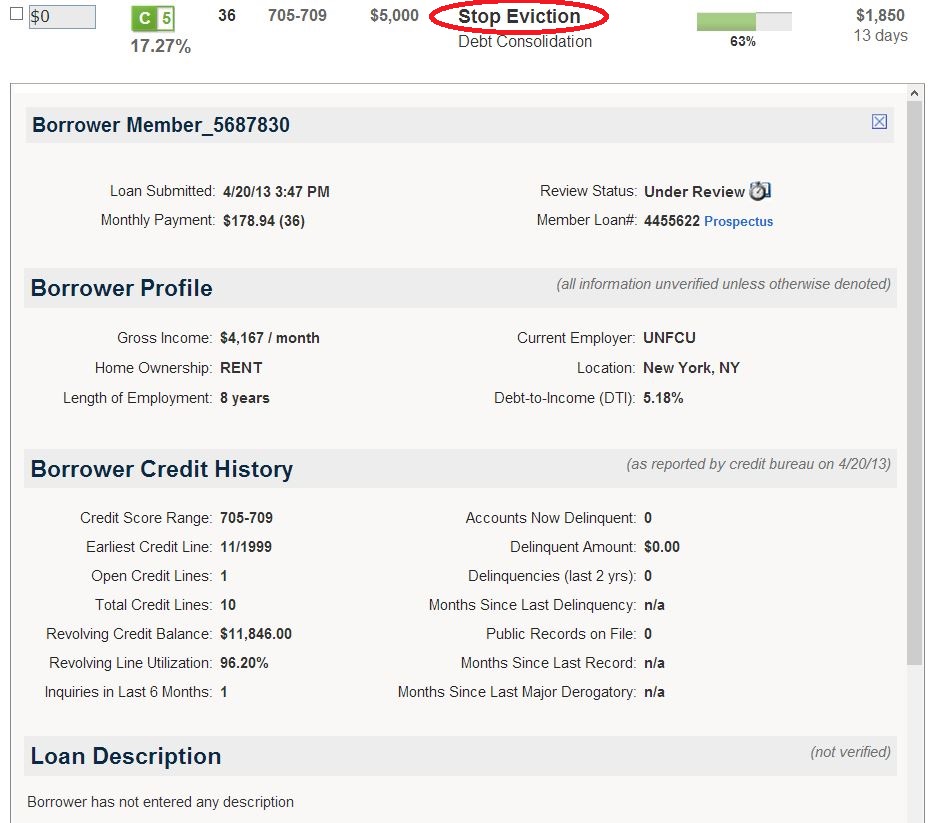

By just looking at the traditional credit metrics, this loan looks to be pretty compelling:

- High credit score: 705-709

- Pays on time: 0 delinquincies, major derogatory loans, and public records

- Not applying for a lot of credit: Only 1 inquiry in the past 6 months

- Only 1 open credit line – this borrower doesn’t have a stack of credit cards

- Only asking for $5,000

However, simply reading the headline paints a much different story: “Stop Eviction.” The borrow later posted a Loan Description (after I captured this screen shot):

I am currently very behind on my rent (due to previous financial issues) and I am facing eviction. I’m in desperate need of help. I can now make my rental payments in full as of next month.

With the additional context, the loan has a much different risk profile. A payday loan provider might consider loaning this person the money at triple-digit rates, but a 17.27% interest rate is not sufficient (in my opinion) to cover the risk of the loan, despite the favorable credit metrics.

Will this loan pay in full? Perhaps. But the point is that the return is not worth the risk. Someone who relies on automated investing tools, pure algorithms, or even pooled funds could get stuck with loans like this. With Peer Lending Advisors, this type of loan will never appear in your portfolio.

Interested in investing with a pro?

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Phone’ type=’text’/][/contact-form]