Google made waves today when they announced a $125 M investment round in Lending Club, valuing the company at $1.5 B. What does this mean for Peer-to-Peer Lending?

1. Peer-to-Peer Lending has tremendous potential

Less than a year ago Lending Club did a venture funding round that valued the company at about $500 million. Now they’re worth three times that.

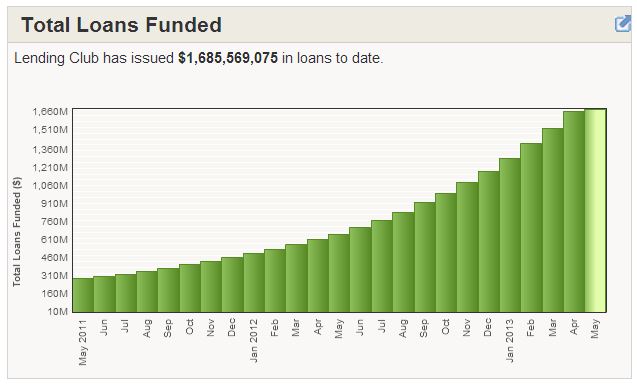

Lending club has issued $1.7 B in loans to date, and the growth trajectory is tremendous. Lending Club is here to stay and the Peer-to-Peer Lending model is a force. Google’s investment only reinforces this.

2. Lending Club is looking to grow

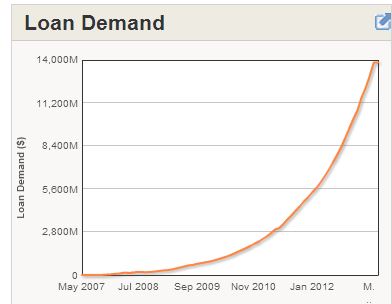

Lending Club is ready to ramp up originations. Loans are being funded within hours instead of within days. The company needs to find more borrowers.

3. A Google-Lending Club partnership is a great match – and could make Lending Club profitable

Google is an online marketing machine, making the vast majority of their profit through online ads. They have perfected the art of presenting the right ad to the right customer at the right time.

Lending Club needs to scale their marketing even further. They’re spending $11 M per quarter to generate their originations. They could leverage Google’s massive data capabilities to target customers better. Cutting their origination expenses by 10% would turn them from unprofitable to profitable. For a company looking to go public in the next 1-2 years, this is a must-do.

4. Is Google getting further into financial services?

Google Payments have been around for years, and the Google Wallet feature on Android phones is a very convenient feature. Is Google planning on adding lending to their massive arsenal?

Think about it. You’re at the car dealership and are negotiating a car purchase. Google Now on your phone can geo-spatially detect where you are, and pop-up an offer for a $10k car loan at 8% interest. Google already knows who you are, and could be a player in financial services by always being in your pocket.

Walmart has jumped into financial services by applying (and being rejected) to start their own back, and having their own prepaid card. Google could be next.

5. Could Lending Club add social networking data to its proprietary lending model?

The possibilities for adding Internet behavior data to credit profile data is compelling. Can you imagine if the credit bureaus could access your Facebook data, see who your friends are, the types of posts you publish, photos, etc., and used that data to determine your credit worthiness. If you’re friends with a bunch of people with low credit scores, what does that mean about your credit profile – probably not good.

Lending Club and Google could potentially partner to make this happen with Google+. While Google+ remains a virtual wasteland of activity, growth could ramp up and become a valuable data source.

Are you missing out on the possibilities of Peer-to-Peer Lending? Peer Lending Advisors can help. Sign up to get more info:

[contact-form subject=’5 Takeaways’][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Phone’ type=’text’/][/contact-form]