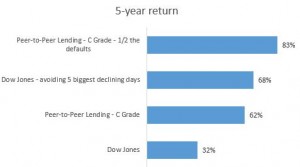

If you invested in the Dow 5 years ago, you’d have made about 32% on your money. Not bad.

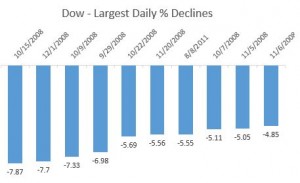

However, if you’d have managed to avoid the 5 biggest daily declines for the Dow, ranging from 4-8% losses in a single day, you’d be up much more than that. The 5 biggest declines totaled 36%, making your total return 68%. Avoiding the down days is actually more profitable than buying and holding over 5 years.

How do you avoid the biggest daily declines? It’s virtually impossible. Many of the biggest declining days were next to the biggest jumps in the Dow. For example. The biggest gain for the Dow in the last 5 years, October 13th, 2008, was 2 days before the biggest daily decline, October 15th, 2008. How many people were all-in on the 13th, but cashed out by the 15th? Not many. And you would have been foolish to stay out of the market after the 15th – on October 28th the Dow was up another 11%.

The lesson is that timing the market is impossible. Experts use techniques such as dollar cost averaging to spread buying over time to try to even out the randomness and volatility of the markets.

Peer-to-Peer Lending is different*

In Peer-to-Peer Lending, there’s no timing the markets. You invest in loans with a 3 year duration, and typically hold until they mature (there is the option to sell the loans on the secondary market). Investing money over time still makes sense, but there’s much less volatility – there are no down days and up days.

In Peer-to-Peer Lending, if you select the correct loans to invest in – the ones that will pay back their loan in full, and avoid the loans that will default, you’ve effectively “timed” the market, but in a much better way.

For example, if you invest in “C” loans that typically pay 15% interest and the average return is 10%, 5% of the value is lost to default. However, if you’re able to avoid half of the defaults, your return increases 25% to 12.5%.

Add up the returns over 5 years (including the effects of capitalized growth), and you come up with some strong returns numbers. The base case – 10% returns, gives you a 62% return over 5 years – much better than the Dow alone, but not quite as good as the Dow excluding the 5 biggest declining days.

However, the 5 year return for the example, low-loss case in Peer-to-Peer Lending – essentially cutting your default rate in half – is a whopping 83% over 5 years. Again, this return is higher than the Dow + the impact of magically avoiding the 5 biggest down days in the last 5 years.

How do you select the right loans in Peer-to-Peer Lending?

You could try to build your own model to analyze past loan performance and predict future performance. That takes time, money, and expertise.

Or, you could entrust the job to the only Investment Adviser focused 100% on P2P Lending – Peer Lending Advisors, having already done the work for you, so you can leverage the model and manual underwriting processes.

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Phone’ type=’text’/][/contact-form]

*Past performance is not a guarantee of future results. Sources: Wikipedia: http://en.wikipedia.org/wiki/List_of_largest_daily_changes_in_the_Dow_Jones_Industrial_Average; Yahoo: http://finance.yahoo.com/q/hp?s=%5EDJI+Historical+Prices. Lending Club: https://www.lendingclub.com/info/demand-and-credit-profile.action