Peer-to-Peer Lending is an exciting consumer lending opportunity. While the credit card democratized credit for the masses, Peer-to-Peer Lending has broken down the banker’s door.

- For consumers, it has cut out the middle-man, lowering interest rates and increasing access to credit.

- For investors, it has allowed access to debt that was previously only accessible to the largest banking brands on earth.

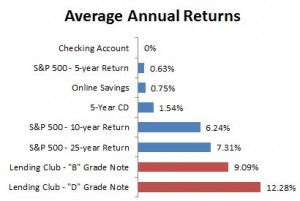

Source: finance.yahoo.com and Lendingclub.com. March 2013.

What kind of returns can I expect?

Peer Lending Advisors will customize your portfolio based on the yield you desire and your appetite for risk. For most investors, this includes managing not only the near term upside, but also the long-term downside.

What are you waiting for?

Contact Peer Lending Advisors to create the custom portfolio that meets your investment objectives.